Solvency analysis:

No more risks of non-payment!

Natural and legal persons

Categorization and aggregation of data via open banking to define a prediction score

Move forward with your confidence with your customers. Our solution makes it easier for you to make decisions for both natural and legal persons.

Reduce the risk of fraud by 4 thanks to plug and play

Verify the identity of a company, an applicant and its creditworthiness

to obtain a delinquency prediction score

to analyse the creditworthiness of a profile

Profiling and scoring for your growth

Get an automated award decision in less than 5 seconds

Solvency analysis

Secure your sales so that you can concentrate on your core business, with complete peace of mind

Meelo takes care of collecting all the elements necessary to analyse the creditworthiness of individuals or companies.

Thanks to open banking and the categorization of financial data operated by our machine learning and artificial intelligence models, our approach makes it possible to establish a scoring that goes beyond simple theoretical data.

Our more detailed analysis allows us to anticipate profiles at risk of non-payment… All these elements combined to establish a prediction score in a few seconds and limit the risk of non-payment.

Open Banking

Categorisation

Cutting by NLP

Identification Keywords

Recurrence / time analysis

95% of transactions categorized

Predictive score for non-payment

Tax return

Data & Ratios

95% of transactions categorized

Predictive score for non-payment

Solvency analysis

An approach that goes beyond theoretical scoring

The fight against the risk of non-payment tends to exclude atypical profiles, which are wrongly considered less reassuring. This is true even if they pay their bills.

This approach can penalise you by causing a real loss of business. The Meelo approach is to identify the good payers. Because it's all about balance.

It is essential to make commitments responsible in order to fight against over-indebtedness without closing access to young people, to workers who are not on permanent contracts.

fraud

review

analysis

support

Everything you need to know about solvency analysis

to combat the risk of non-payment

Open banking is characterised by the sharing of data collected by banking institutions on their customers with other companies.

This concept makes it possible to recover, with the customer's consent , 4 months of banking transactions.

This data is essential to enable credit or loan applications to be examined and to combat the risk of default.

Meelo via the aggregators retrieves this data to establish a prediction score.

Our credit analysis solution is aimed at both individual and legal entities(companies).

In just a few seconds, you can get a prediction score based on

Meelo is able to analyse risky profiles via a dedicated solution for analysing the creditworthiness of customer.

How ?

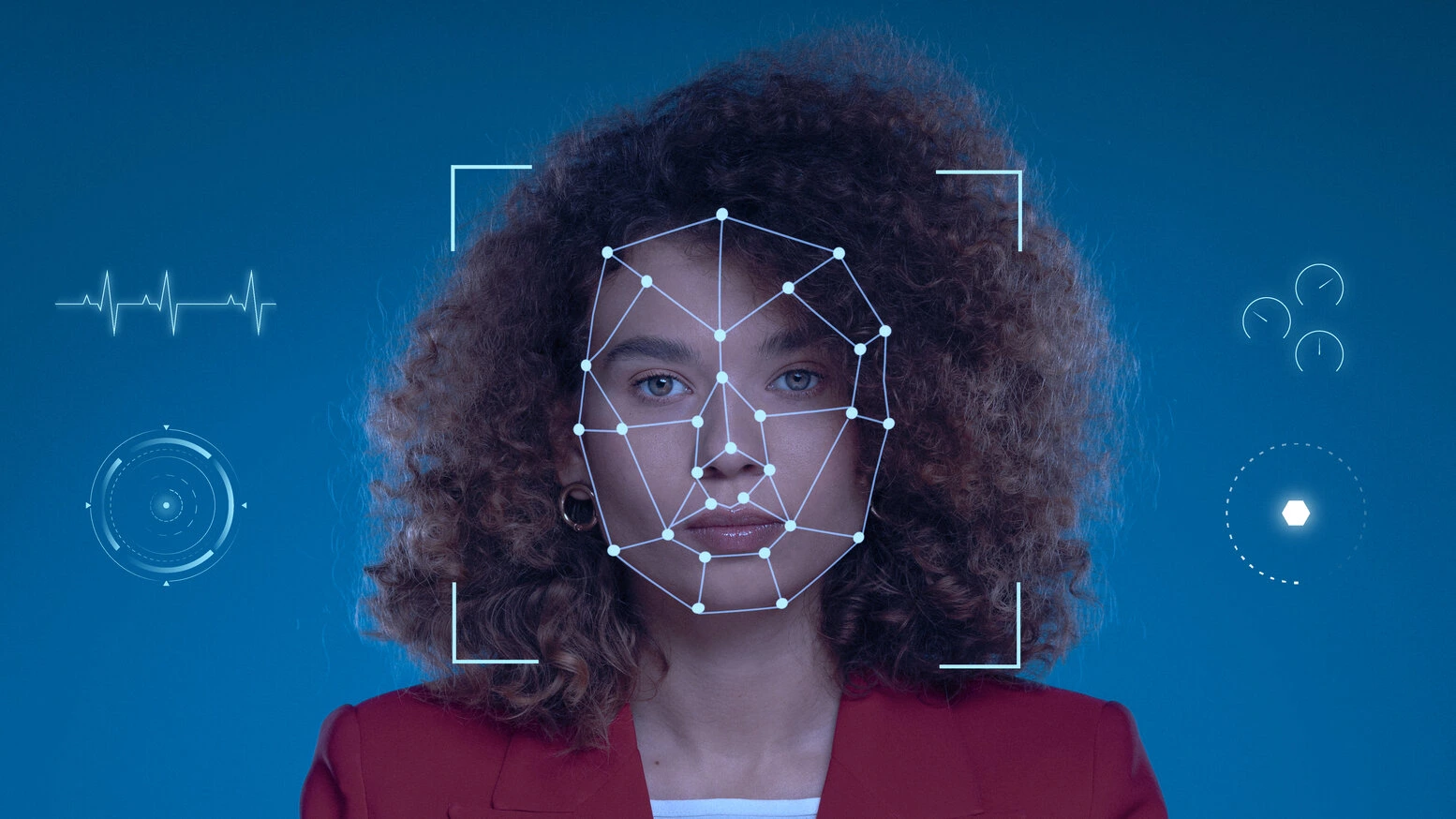

By checking the customer's profile, which is assigned a reliability score based on more than 500 data items. The algorithm is thus able to collect and analyse the information that customers leave available to everyone on the Web to study its consistency with what is declared. In this case, the banking data of a bank in an open banking approach.

This solution is the result of the combination of artificial intelligence and open banking.

PSD2 is a directive that has led to the widespread adoption of Open Banking.

This has led the creation of two new regulated payment services:

- account information services (“ SIC ”): the customer gives a trusted third party access to information about his payment accounts held with account management payment service providers

- payment initiation services ( SIP ): Customers make payments to third parties directly through a TC.

Firms that offering SICs and SIPs must be regulated or registered with their local financial regulator and must comply with certain obligations when providing these services.

Meelo offers you a solution that makes it easier for you to make credit decisions. Our solution is the most advanced on the market in terms of credit risk management.

Indeed, our scoring takes the approach of categorising the data although this is not mandatory for decision making.

It would be simplistic to rely solely on financial data such as account balance or the number of days overdrawn each month.

Our analysis goes further and is based on human behaviour, as financial data do not take into account savings-type behaviour.

And this is where categorisation comes in. It brings a finesse to the analysis that financial data alone cannot do.

Categorisation gives meaning to financial flows. Our credit risk prediction score allows for finer profiling.

Our credit analysis solution is also for companies ! In just a few seconds, you can decide whether or not to trust the company.

Meelo takes care in a few seconds of collecting all the elements necessary to identify a company (Kbis, tax package), of verifying the identity of the applicant and his capacity to commit the company then of analyzing the solvency thanks to intelligent data aggregation (financial ratios, current procedures and potential reactivations).

This solution concerns all types of companies, including micro-enterprises.

In this case, we use Open Banking and a B2B score to analyse the creditworthiness of this company.

Meelo: B2B anti-fraud solution, guarantor of growth

In the business world, B2B fraud is an insidious scourge that threatens the financial stability and reputation of companies. From shell fraud to identity fraud, the challenges are numerous and complex. However, a rapid and effective response is necessary to ensure the sustainability of commercial activities. That's where Meelo comes in. With its innovative B2B fraud solution, Meelo offers a comprehensive, proactive approach to securing transactions and protecting businesses from financial risks. Let's discover together how Meelo can transform the way your business manages B2B fraud and ensures its growth.

Capitole x Meelo: co-building responsible anti-fraud solutions

Capitole Finance-Tofinso specializes in rental financing for professionals and individuals. With recognized expertise in Furniture Leasing, Auto Leasing and Boat LOA, Capitole offers its customers tailor-made products that meet all their financing needs. Born from a desire to co-build sustainable solutions to combat fraud, the collaboration between Capitole and Meelo uses AI technologies while relying on Capitole's expertise in risk management.

Meelo: A fintech committed to responsible financing

Meelo, an innovative fintech company, recently achieved the prestigious B Corp certification, marking its commitment to sustainability and social responsibility. Founded in 2017 by Laurent Kocinski and Mohamed Hadiri, Meelo quickly emerged on the market with a clear mission: to offer businesses a global and innovative solution to fight fraud and unpaid debts, while protecting end consumers. After four years of continuous efforts, Meelo reached another milestone in January 2024 by becoming a certified B Corp.