Our scoring solution for companies

Check customer data in real time and consistency with their identity

(address, email, telephone, date of birth)

Discover our solution for identifying fraud in business.

Reduce the risk of fraud by 4 thanks to plug and play

Reduce the risk of fraud by 4

report at least

one fraud attempt in 2022

allow us to

effectively monitor the profiles

Detecting and blocking fraudulent profiles

A turnkey solution or modules interrogated through APIs

Score fraud :

How does it work ?

Open Data

0-100

fraud

review

analysis

support

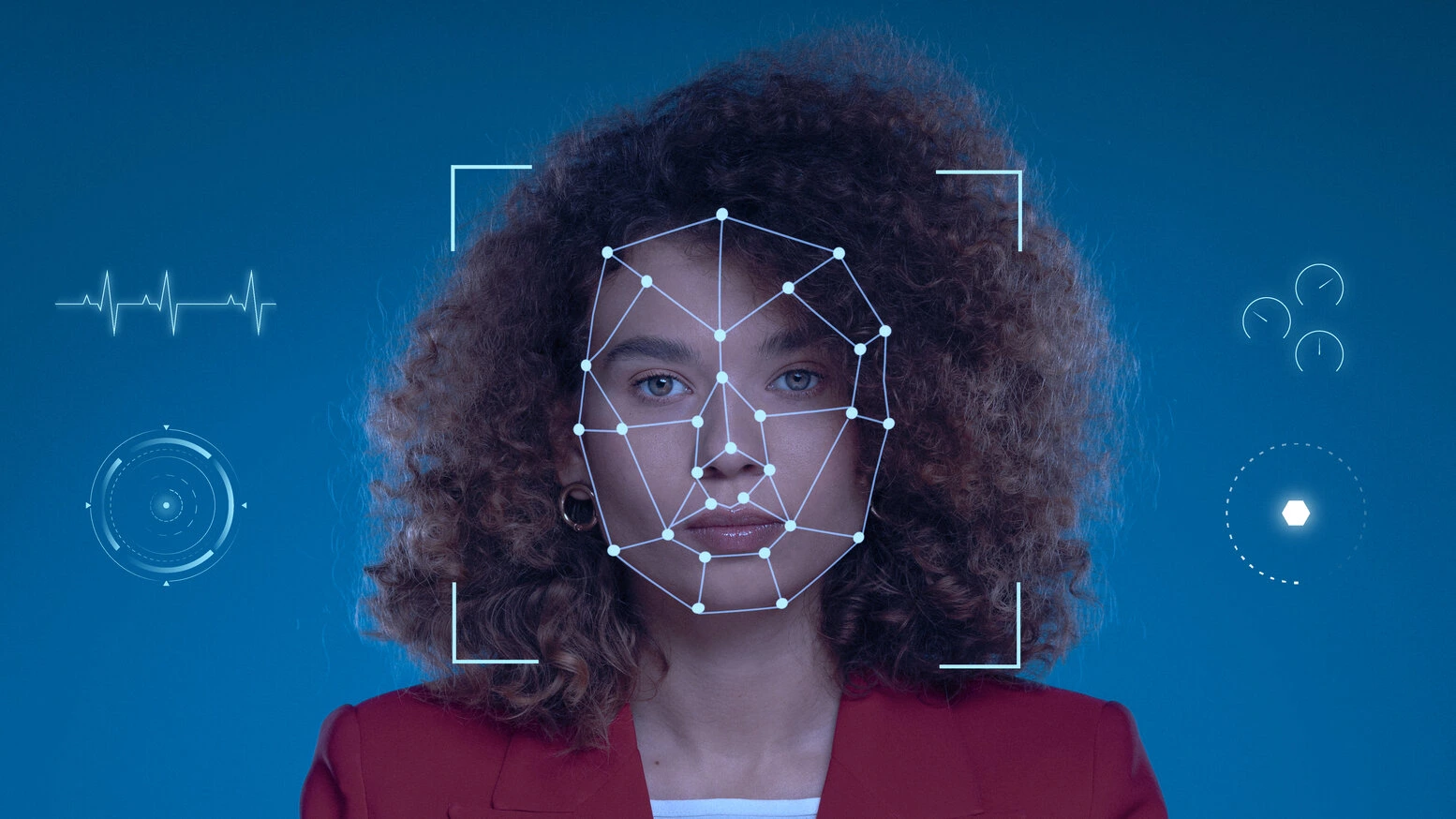

The fight against identity fraud

in practice

Meelo combines big data analysis with other technologies to optimise the fight against identity fraud :

- rules and scores (risk limits and statistics)

- machine learning? these are algorithms of constant improvement of analysis tools

- digital identity scores

- certification of data by trusted third parties who already know the customers

Our algorithm works through the combination of artificial intelligence and open data. It checks in real time that the customer's data is consistent with his identity.

The Score Fraud solution checks the customer's profile and assigns a reliability score based on more than 400 data. The algorithm is able to collect and analyse the information that customers leave available on the web to verify consistency with what is declared. Machine learning allows fraud to be identified before it occurs.