Documentary analysis:

our solution to combat documentary fraud in business

Check that the supporting documents provided by your customers have not been altered and analyse the veracity of the information automatically and in real time

Our document analysis solutions

Certify, authenticate and verify the authenticity of documents in a single connection

Certification

of Identity Document

and calculation of

relevant

Checking for tampering

Automated

DGFIP query

bank customer membership

500

trained data to analyse documents

90%

reduction in the risk of document fraud

57%

of companies declare fraud in 2022

A verification

that covers all types of documents

Our solution works on the basis of an algorithm that checks wether the documents submitted (pay slips, identity papers, bank statements) have not been falsified.

Pay slips

Identity papers

Bank statements

Tax notice

Your need

Spot

fake profiles

Verify that documents have not been altered and analyse the information present automatically and in real time.

Thanks to artificial intelligence and open data, our algorithm checks in real time that the client's data is consistent with his identity (address, email, phone number, date of birth) and that the documents submitted (pay slips, identity papers, bank statements, etc.) have not been falsified.

The most complete solution on the market to limit fraud and risks

Questions

In the banking, credit, insurance or real estate sectors, the risks of documentary fraud are very high. Hence the need to develop effective KYC

These offenses are severely punished by law, but they are becoming more and more democratic. They cost companies thousands of euros every year.

To avoid the risk of fraud, documentary verification is essential.

Documentary fraud is the most common form of fraud and is perpetrated through various means :

- The counterfeit:

This is the complete reproduction of a document. It is generally quite easy to detect and rarely incorporates all the security features present in the authentic document, butas the technical sophistication of fraudsters increases rapidly, very good counterfeits are beginning to appear. Counterfeiting is frequently carried out on identity documents in the context of creating a customer account on the internet. This is why companies must be particularly vigilant about verifying the identity of their customers. IDcheck.io allows companies to provide themselves with fraud protection services.

- The falsification:

This method of fraud involves making changes to an existing identity document.

The changes can be simple (date of birth or validity for example) or more complex. The original document may be the one presented by the fraudster or be a stolen document.

It can be very difficult to recognise this type of fraud with the naked eye. This is why it becomes essential for companies to have a document fraud detection solution.

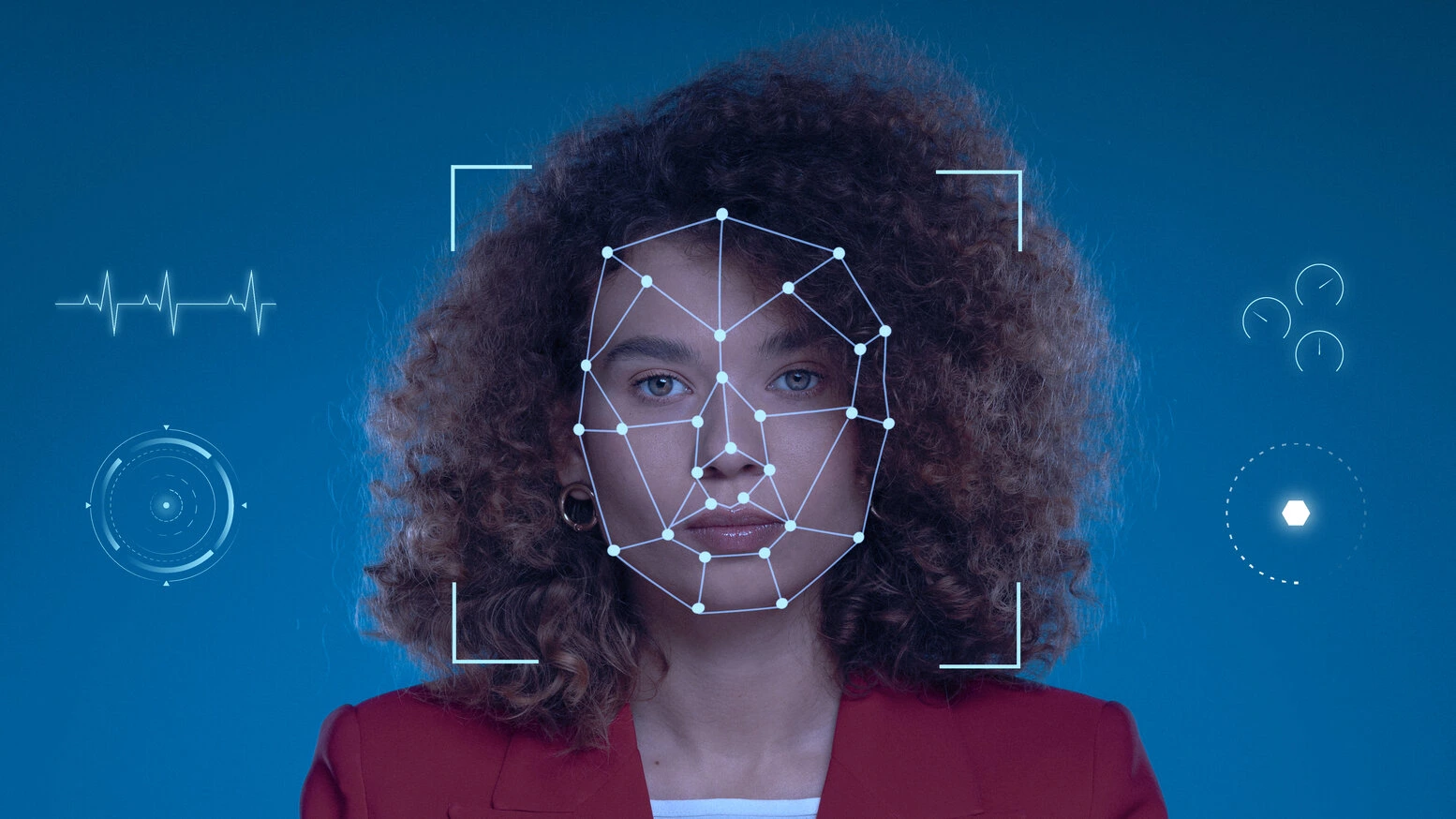

- Identity theft:

Identity theft is difficult to detect with simple ID verification. Impersonation can only be detected by cross-checking.

It is therefore necessary to develop a enhanced identity verification.

Thanks to its fraud score, Meelo checks the customer's identity document. But above all, it is able to know if it is really the person he claims to be.

ID verification can be complemented by a facial recognition service.

What are the methods for detecting document fraud?

We use a process called OCRisation. This process consists of optical character recognition. It takes place in several stages: pre-analysis, image segmentation, character recognition, post-processing, generation of output format, etc.

OCR is used to read documents. It then needs to be combined with Artificial Intelligence to understand the information read by the OCR and make sense of it. Once the document is understood and the information is extracted, it is possible to detect inconsistencies with other available data.

This ability to make sense of information comes from machine learning trained with more than 500 data sets at Meelo.

Document fraud is very widespread and there are many false documents.

- Real documents falsified in order to change the information.

- False documents made from scratch.

- Fraud of conveniance by a provider who, knowing that the insurer will reimburse the damage, increases the bill.

- Fraud related to identity theft.

The document is a preferred entry point for fraudsters.

Whether it is a question of taking out insurance or applying for a bank loan, the user must provide identity documents, tax returns and proof of residence in order to have his or her application examined.

As you can see, the document is everywhere. The subject of document fraud is more than common.

Thus, the security and protection of documents is a priority issue in the management of documentary processes and in the fight against fraud.

fraud

review

analysis

support