Verification based on reliable data.

Mobile ID directly queries the main telephone operators in France (Orange, SFR, Bouygues, Free) to verify critical identity information such as name, first name, email, or full postal address. This integration further secures your processes while maintaining a smooth user experience.

With 80% coverage of lines in France, Mobile ID guarantees a reliable and fast identity verification solution for the vast majority of users. This extensive coverage makes Mobile ID an essential tool for strengthening the security of identification processes for companies operating in France.

The Meelo : optimized security for maximum efficiency.

Meelo's approach is based on a simple principle: securing customer journeys without weighing them down.

By integrating Mobile ID into our identity score solution, we have sought to combine precision and speed, because we know that in many sectors (including financial services, rental and online sale), time is a critical factor. A verification that takes too much time can lead to abandonment of processes, commercial losses or even a negative user experience.

Thanks to Mobile ID, we guarantee an verification of identity information in a few seconds, without sacrificing precision or security.

Our teams at Meelo are constantly working to improve our solutions by taking into account the feedback from our customers and integrating the most advanced technologies, such as open data and artificial intelligence.

This allows us to offer a solution always up to date and adapted to the specific needs of companies in a world where fraud is constantly evolving.

Concrete benefits of Mobile ID.

Strengthening identification processes :

Thanks to Mobile ID, you benefit from an additional layer of verification, directly connected to telephone operators, thus strengthening the security of your transactions.

Real-time verification :

Mobile ID works in the background transparently to the user, providing fast results without slowing down your processes. In just a few seconds, you have a clear assessment of the reliability of the information transmitted.

Adaptability to specific needs :

Mobile ID is available both via our Meelo portal and via API, to adapt perfectly to your needs. Whether you need a ready-to-use solution or tailored integration into your internal systems, Mobile ID can adjust to your environment.

Continuous improvement in your identity score:

Integrated into the Meelo particular identity score, Mobile ID contributes to a constant improvement in the accuracy of our detection models.

The use of data provided directly by telephone operators allows you to reliably check critical information.

This significantly improves the quality of the scores provided to our customers, while reducing the number of manual checks required.

What are the security issues related to identity verification?

The verification of identity is a crucial security in terms of security, particularly in the digital context where the protection of personal data and brands has become essential.

The integration of robust identity verification systems ensures that shared or accessible content comes from authentic sources, thus reducing the risk of fraud and cyber attacks.

For brands, this means not only to protect their integrity and reputation, but also guarantee a secure and reliable user experience.

In addition, by preventing identity theft, companies can preserve consumer confidence while complying with confidentiality and data protection regulations.

In short, an effective identity verification constitutes an essential pillar to secure both content and brand image in a constantly evolving digital environment.

Why choose an identity verification solution?

Choosing an identity verification solution is essential to secure the operations of a business in today's digital world.

The solutions like Mobile ID of Meelo offer precise verification of user identities, contributing to more reliable and fast decisions, without complicating the customer journey.

The integration of such a solution strengthens security, reduces the risks of fraud and usurpation of accounts, and ensures compliance with strict regulations such as AML and KYC .

In addition, they improve customer confidence by securing their interactions and optimize operational efficiency by making the process of rapid and fluid recording. Although the implementation can involve an initial cost, the savings generated by the reduction of fraud and security incidents are significant.

Meelo , through mobile id, not only simplifies these processes, but also provides better prevention of fraud while offering a user experience without friction.

Adapting these solutions is therefore a strategic choice for security , regulatory compliance and customer satisfaction , while promoting sustained growth and innovation.

Measurable results for your business

Businesses using Mobile ID quickly see:

- A risk reduction linked to identity theft

- A decrease in costs associated with fraud management

- An improvement in the conversion rate thanks to an optimized customer experience

Meelo's specific identity fraud score

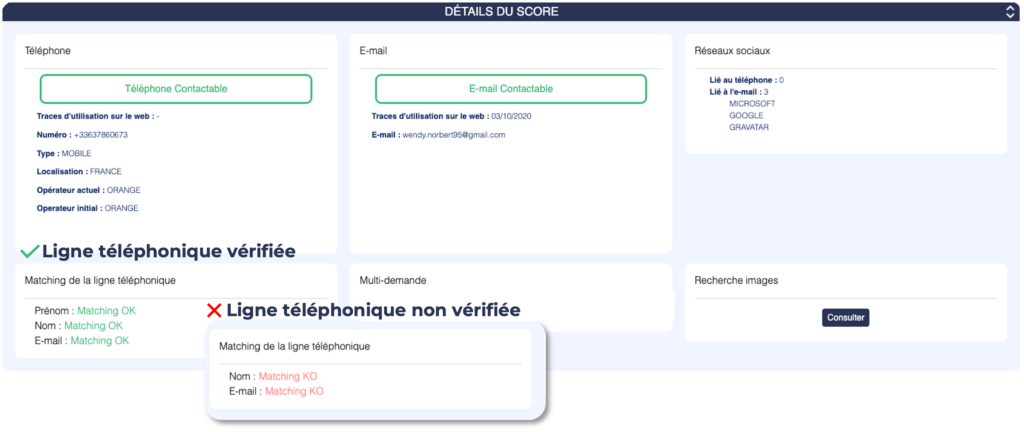

particular identity fraud is designed to assess in real time the risks linked to identity theft and attempts at documentary fraud.

This score is calculated from critical data, such as name, first name, email, telephone number and other information related to identity. Fueled by reliable data sources and artificial intelligence, it offers a complete and rapid evaluation of the potential risk of each request.

This score, ranging from 0 to 100 , makes it possible to quickly detect suspicious behavior and automate decisions. Companies can thus prioritize risk files, while guaranteeing a fluid process for legitimate customers. Thanks to an in -depth analysis and artificial intelligence algorithms, the identity fraud score considerably reduces false positives and financial losses.

The results are immediate:

- A reduction in the risk of fraud

- Better user protection

- An optimization of acceptance decisions

By integrating the identity fraud score in your processes, you ensure both security , compliance and commercial performance .